Debasis Mohapatra

Bengaluru, 4 October 2024

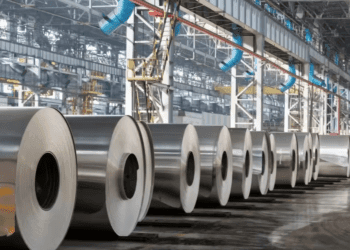

Micron, one of the world’s largest semiconductor companies, will see high capital expenditure in fiscal 2025 than the previous fiscal year as it builds multiple greenfield semiconductor manufacturing units.

According to the company, it invested $8.1 billion in capital expenditure in 2024. This was shared in the analyst call in its recently concluded fourth quarter results.

“Micron invested $8.1 billion in CapEx in fiscal 2024. We expect fiscal 2025 CapEx to be meaningfully higher and at around the mid-30s percentage range of revenue based on our current CapEx and revenue expectations. The growth in both greenfield fab construction and HBM CapEx investments is projected to make up the overwhelming majority of the year-over-year CapEx increase,” Sanjay Mehrotra, CEO of Micron Technology has said.

The company is investing in setting up multiple fab units, spreading across the US, China and India.

“We continue to make progress on the construction for our new fab in Idaho and are working with state and federal agencies on the permitting process for our New York site. Construction is underway on our India assembly and test facility, as well as our China Xi’an back-end expansion,” Mehrotra has said.

Micron reported sound set of fourth quarter and fiscal 2024 results recently. Its fiscal 2024 revenue was at $25.1 billion, up 62% year-over-year basis. The company achieved record high revenues in NAND and its storage business unit.

With AI adoption rising across the world, the company is focussed on cashing in those emerging opportunities.

“Micron is focused on translating the opportunities from AI demand into value captured for all our stakeholders. Demand from data center customers continues to be strong and customer inventory levels are healthy. Industry server unit shipments are expected to grow in the mid-to-high single-digit percentage range in calendar 2024, driven by strong growth for AI servers as well as low single-digit percentage range growth for traditional servers,” Mehrotra has said.