Pune, 7 June 2025

In a surprise decision, the MPC today cut the policy rate by 50bps to 5.5% – beating our and market expectations of a 25bps rate cut. The RBI went a step further and delivered a significant 100bps reduction in the CRR rate to 3% (to be reduced in a graded manner over the coming months). The clear signal from the RBI today – both from the policy decision and comments – is that the central bank wants to frontload monetary easing and get ahead of the growth slowdown. It is also in some sense a recognition of the lingering growth risks due to an unpredictable global growth and trade scenario.

- Where do we go from here? The RBI changed its stance from accommodative to neutral, opening policy options beyond rate cuts. The governor clarified in the post policy press conference that given current circumstances there is “limited space for further monetary policy easing” – which means that the bar for further easing has been raised.

- Pause ahead: This essentially implies that policy decisions now become heavily data dependent and only if growth shows significant signs of weakness will the RBI look at cutting rates further. We therefore believe that it is highly likely that the RBI now stays on pause at least in the next two policies (August and October). Given the inflation trajectory, the RBI has space to cut the repo rate by another 25-50bps in this cycle, but we see the probability of that happening to be low at this stage. For now, in our base case, we see the policy rate remaining unchanged at 5.5% for 2025.

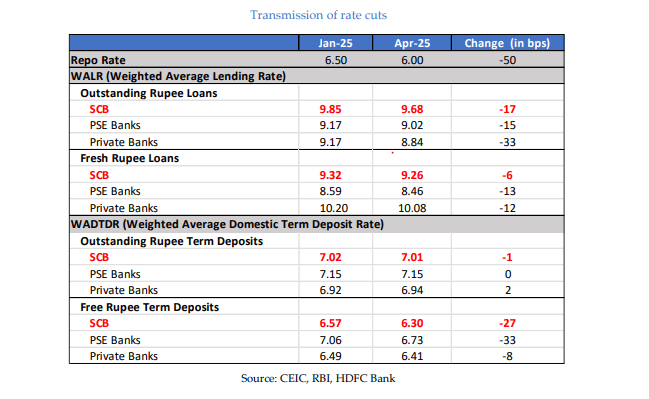

- The operating target rate: So far, by keeping liquidity conditions comfortable, the call money rate (target operating rate) has been close to the lower band of the policy corridor at the SDF rate. While the governor did not commit to continuing this strategy going forward after today’s 50bps rate cut, we believe that it is likely that the RBI could continue to anchor the call rate at the SDF rate (which would effectively imply an additional rate cut with the SDF rate at 5.25% after todays’ decision) in order to fasten transmission of rate cuts. In case, transmission is seen as satisfactory or liquidity surplus increases substantially, the RBI could then move towards conducting VRRR and anchor the call rate towards the repo rate eventually.

- Making sense of the CRR cut: The reduction in the CRR rate to 3% from 4% seems to go beyond the RBI’s intention to supply primary liquidity in the system and reduce the cost of funding for banks in the short-term. The governor mentioned in the post policy press conference that a 3% CRR rate now aligns with the needs of liquidity management — therefore it perhaps reflects a more fundamental change in response to the changing financial system. A high CRR rate tends to reduce the pool of lendable deposits with the bank and weighs on the money multiplier (which influences money supply growth). To recall, historically the CRR rate has averaged close to 4%, barring a few episodes like the pandemic.

- Near-term implications of CRR cut: The 100-bps cut in CRR to 3.0% will be implemented in four tranches from 6th September 2025 onwards. The CRR cut is estimated to infuse ~ INR 2.5 tn of durable liquidity into the system and is a positive step for medium-term liquidity conditions. However, in the coming months, we believe that some of this liquidity infusion could be offset by the RBI reducing its short forward book.

- As of April 2025, RBI’s forward book stood at (-) USD 53 bn (up to 1 year segment). Between February 2025 and April 2025, RBI reduced its dollar short position by ~ USD 26 bn which would have translated to a rupee liquidity drain of ~ INR 2.3 tn. However, during this period, RBI also conducted OMO purchases worth INR 2.6 tn which would have helped offset the impact from the unwinding of its dollar short position.

o From the current level, if RBI wants to reduce its forward book (up to 1 year segment) by ~50%, it will result in a rupee liquidity drain of ~ INR 2.3 tn and it will be ~ INR 3.0 tn, if the RBI decides to let ~70% of its forward book mature.

o During the press conference, RBI Governor said that the central bank would be comfortable with its FX reserves position even with the maturity of its forward book size. We believe that the liquidity infusion through the CRR cut would help cushion the rupee drain from the maturity of the RBI’s forward book over the coming months. As a result, the expectation of any further large OMOs (which would have been used to offset the liquidity drain from letting the forward dollar position mature) is now limited.

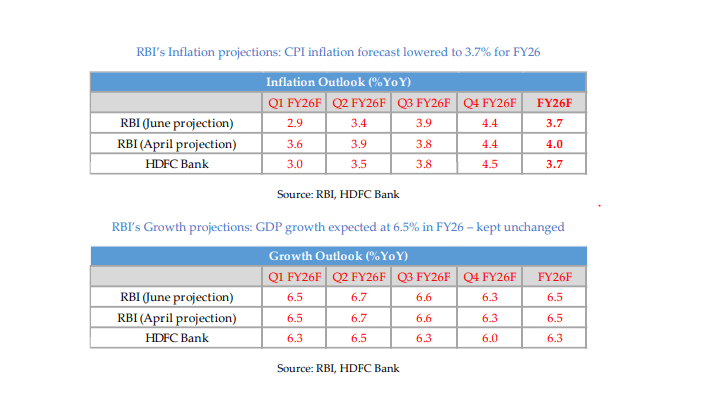

- Growth: The RBI kept its GDP forecast unchanged at 6.5% while revised the inflation forecast by 30bps to 3.7% for FY26. We keep our GDP forecast unchanged at 6.3% for the yearfor now given lingering global headwinds (the slowdown in the advanced countries like the US are yet to play out and could act as a drag from domestic exports), lack of clarity on the trade deal with the US and given that private investments are expected to remain moderate this year. That said, the frontloading of rate cuts and liquidity easing does present a mild upside to our forecast. The strength of the revival in domestic consumption and labour market would be critical in this regard.

- Inflation: On inflation we continue to expect average inflation of 3.7% for the year, with downside risks to our forecast now emerging – contingent on how the distribution of monsoons and the consequent impact on food inflation pans out. In the near term, inflation could print below 3% for May 2025 given the continued moderation in food inflation.

- FX view: The USD/INR strengthened and was trading at 85.70 at the time of writing vs. its opening level of 85.91 and previous close of 85.79. Looking ahead, we expect the USD/INR to trade in a range of 85.00-86.00 in the near term.

- Bond view: After touching an intra-day low of 6.11%, the 10-year yield was trading higher at 6.22% post the policy (vs. its previous close of 6.19%) – with the RBI changing its stance from ‘accommodative’ to ‘neutral’. We expect the 10-year yield to trade in a tight range of 6.15%-6.25% in the near-term. Given the reduced expectations of further rate cuts by the RBI in 2025, we see 6% as a hard floor for the 10-year yield in FY26.