DBT Bureau

Pune, 9 Jan 2026

Kedia Advisory’s latest report shows gold and silver prices easing as markets brace for commodity index rebalancing, while a stronger U.S. dollar and mixed economic data added near-term pressure.

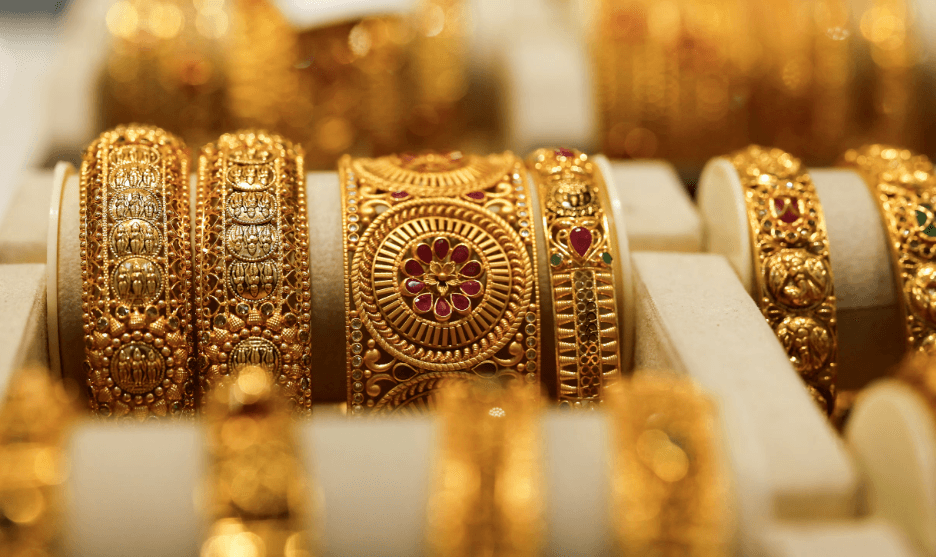

Gold prices edged marginally lower, settling down by 0.19% at ₹137,742, as investors positioned ahead of futures selling linked to the annual commodity index rebalancing, while a firmer U.S. dollar added pressure by making the metal more expensive for overseas buyers. The dollar hovered near a one-month high as markets assessed mixed U.S. economic data ahead of the nonfarm payrolls report, with job openings falling to a 14-month low, signalling some cooling in the labour market. Despite the near-term softness, the broader outlook for gold remains constructive. Major banks continue to upgrade long-term price targets, with HSBC and UBS projecting gold prices could approach $5,000 per ounce in the first half of 2026, citing geopolitical risks, rising fiscal stress, and lower real yields. UBS also highlighted the potential for extreme volatility if political or financial risks intensify. Physical demand showed signs of revival, with gold trading at premiums in key hubs such as India and China for the first time in nearly two months, supported by a correction from record highs. Central bank demand remains a strong pillar, as China extended its gold-buying streak to 14 months, reinforcing bullion’s role as a hedge against currency risk. Technically, the market is witnessing long liquidation, with open interest down 0.93% alongside a price decline of ₹267. Gold has immediate support at ₹136,795, and a break below could test ₹135,845. On the upside, resistance is seen at ₹138,345, with a move above opening the path toward ₹138,945.

Market analysis:

- Gold trading range for the day is ₹135845-₹138945.

- Gold prices fell as investors braced for futures selling tied to a commodity index reshuffle, with a stronger U.S. dollar.

- U.S. dollar hovered near a one-month high as investors assessed mixed economic data ahead of Friday’s nonfarm payrolls report.

- U.S. job openings dropped to a 14-month low in November while hiring resumed its sluggish tone, pointing to ebbing labor demand.

Silver prices declined sharply, settling lower by 2.91% at ₹243,324, as traders positioned ahead of the annual commodity index rebalancing, which is expected to trigger substantial futures selling. Silver remains particularly exposed, with estimates indicating that nearly $6.8 billion worth of silver futures—around 12% of COMEX open interest—could be liquidated as part of the rebalancing exercise. Additional pressure came from a stronger U.S. dollar, while mixed U.S. economic data offered little clarity on the Federal Reserve’s policy path, even as markets continue to price in rate cuts later in the year. Despite the correction, silver continues to trade close to record highs, underpinned by tight physical availability and sustained investment interest. Geopolitical uncertainties, including developments in Venezuela and rising tensions in East Asia, are helping maintain underlying safe-haven demand. Supply-side constraints remain evident, with Chinese silver inventories falling to their lowest levels in nearly a decade following heavy exports, while liquidity conditions outside China remain tight despite rising London vault holdings. HSBC has sharply raised its medium-term silver price outlook, citing support from gold’s momentum and mild structural supply-demand deficits, although it cautions that prices could remain highly volatile. Technically, the market is under fresh selling pressure, as open interest rose by 1.08% while prices dropped by ₹7,281. Silver has support at ₹235,610, with a break below opening downside toward ₹227,905. Resistance is seen at 251,455, and a move above could test ₹259,595.

Market analysis:

- Silver trading range for the day is ₹227905- ₹259595.

- Silver declined as traders positioned for annual commodity index rebalancing, which is expected to trigger heavy futures selling.

- Prices also retreated as the dollar strengthened, with mixed US economic data offering limited clarity on Fed’s policy outlook.

- Citigroup estimating that around $6.8 billion worth of silver futures could be sold.

(Disclaimer: The information is for educational purposes only. Please consult your financial advisor before investing in stocks)